Tempo de leitura: 3 minutos

In January 2026, the Saudi Council of Ministers approved the detailed regulatory frameworks governing the four special economic zones (SEZs) of King Abdullah Economic City (KAEC), Ras Al-Khair (RAK), Jazan, and Cloud Computing. These frameworks will enter into force on 16 April 2026, i.e., 90 days after the publication of the regulations in the Official Gazette (Umm Al-Qura). The frameworks outline a targeted package of incentives, including specific tax and customs exemptions available to qualifying companies and, notably, exemptions from the Saudi Companies Law, the Commercial Register Law, and the Trade Names Law. The regulations can be accessed here.

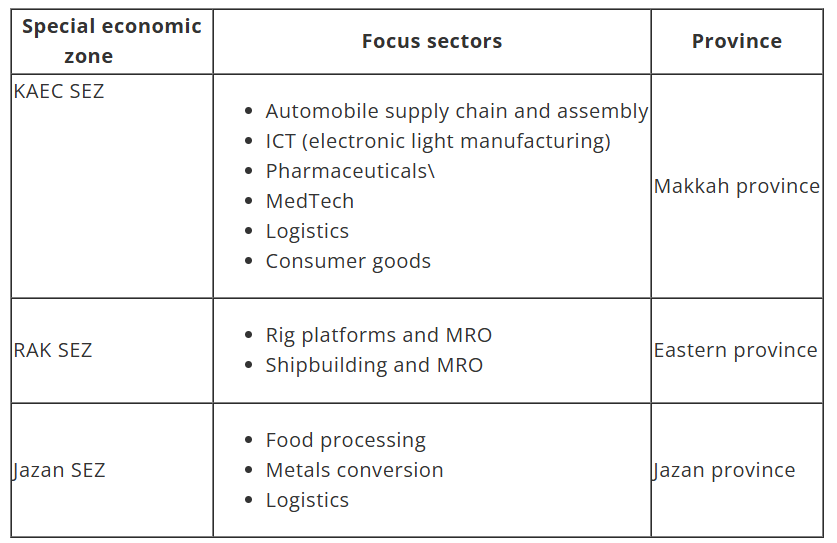

Overview of the SEZs under the regulatory frameworks

The four zones can be sorted into two main categories, each leading to a different set of regulatory and incentives outcomes:

1. Sector-specific, location-based SEZs:

These are zones built around sector-specific clusters shaped by the geography and industrial profile of each location. Each site has its own focus areas, tied to existing strengths or strategic priorities:

2. Cloud Computing SEZ

This zone follows a separate regulatory model. It is designed so that licensed companies can set up and run data centers anywhere in Saudi Arabia while still qualifying for SEZ benefits, provided the company maintains its headquarters in Riyadh.

Requirement to access the SEZ regime

For each SEZ, the concerned authority will issue specific guidelines detailing the conditions, procedures, and requirements necessary for licensing, authorizing, or approving activities within the zone, in full alignment with the governing regulations.

Tax under the SEZ regime

Companies that qualify to conduct activity in one of the four zones, in accordance with the regulatory frameworks and licensing requirements, stand to benefit from the associated incentives, which include tax benefits. A summary of the tax treatment under the newly published regulatory frameworks is provided below:

1. Sector-specific, location-based SEZs

a. Corporate income tax: The licensed company is subject to income tax, in accordance with the provisions in the Tax Law, taking into account any applicable exemptions and incentives.

b. Zakat: Licensed entities operating within an SEZ are excluded from the scope of the Zakat Regulations.

c. Withholding tax: The licensed company is exempt from the withholding tax regulated under the Tax Law.

d. Customs duties: Customs duties are suspended on eligible goods brought into licensed establishments within the zone under approved customs suspension statuses.

e. VAT: Goods exchanged within the same SEZ, between different SEZs, or imported from mainland Saudi Arabia into an SEZ are subject to a zero percent VAT rate, provided certain conditions are met. Moreover, goods imported into SEZs from outside Saudi Arabia may be considered out of the scope of VAT under certain conditions.

2. Cloud Computing SEZ

a. Corporate income tax: The licensed company is subject to income tax, in accordance with the provisions in the Tax Law, taking into account any applicable exemptions and incentives.

b. Zakat: Licensed entities operating within the SEZ are excluded from the scope of the Zakat Regulations.

Key takeaways

Saudi Arabia’s new regulatory frameworks for its special economic zones of KAEC, RAK, Jazan, and Cloud Computing create significant opportunities for investors, from potentially reduced taxes to customs and VAT relief. With various eligibility criteria and tax considerations, navigating the SEZ regime requires careful planning.

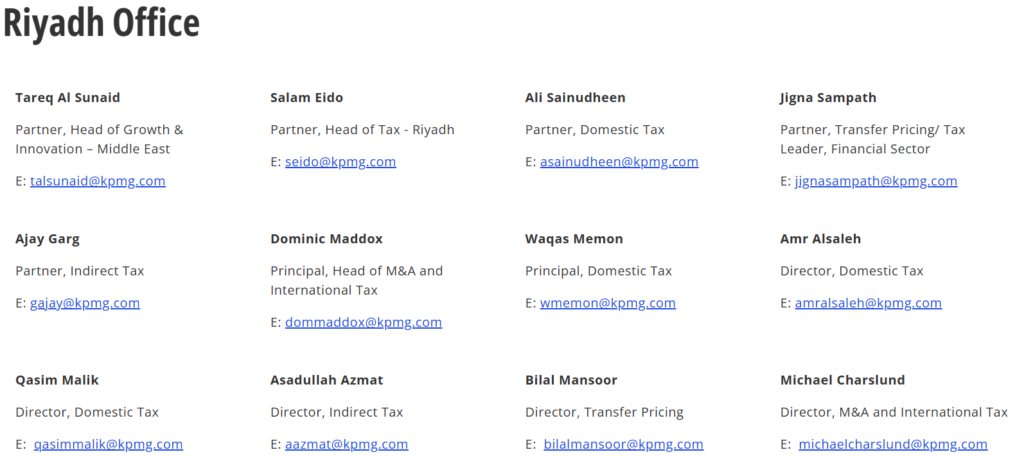

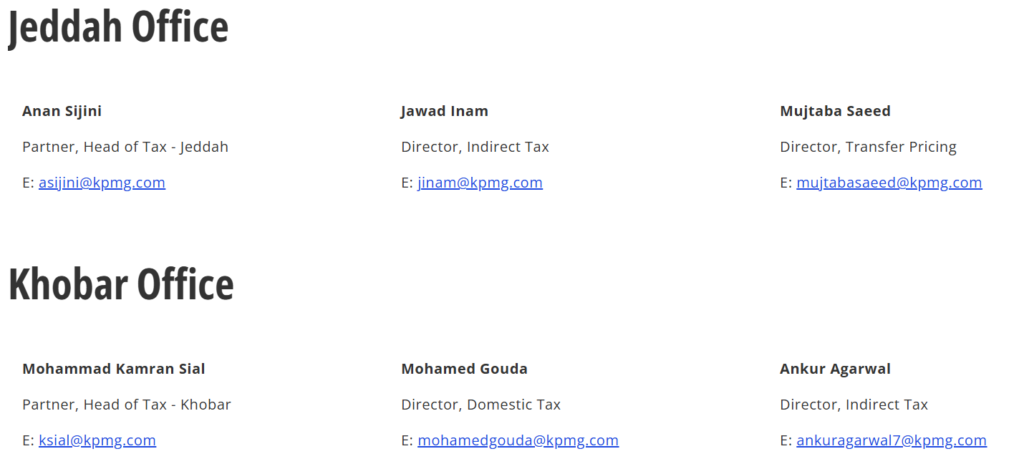

To better understand how these incentives could benefit your business and ensure full compliance, contact our KPMG tax experts today.

Fonte: KPMG | Foto: Pixabay

Os comentários foram encerrados, mas trackbacks e pingbacks estão abertos.